Rethinking Relocation? The Costs of Hiring Foreign Employees in China

Foreign companies who set up operations in China often prefer to employ “one of their own” in a senior position to steer their activity in the Chinese market. The relocating foreign managers are usually excited by the opportunity and the professional challenge, but they (and mostly their family members) are also faced with various challenges, language barriers and cultural gaps. All of these have a price to pay, and therefore, hiring foreign employees in China is no small matter. This post will focus on the financial aspects of employing foreign managers in China.

Salary package

The salary package offered to foreigners who relocate to China is designed to guarantee the same standard of living as they would have enjoyed in their home country. In other words, in addition to the basic monthly salary and social insurances that are provided by law by all employers in China, some companies also include some additional premiums in the salary.

Generally speaking, a typical salary package usually allocates 30% of its total budget towards different allowances such as relocation expenses, housing, international school tuition, daily meals, travel expenses, round trips for a home visit, stock options, or additional international insurances.

Foreign Employees in China: Tax policy and hiring costs

For many years foreigners doing business in China have enjoyed much more lucrative tax benefits than their local counterparts; coming in the form of allowances, incentives and bonuses with the aim of providing a softer landing in China and in order to facilitate their settling into a country and environment that they may be find challenging.

After these tax benefits had ostensibly achieved their goal and foreign-owned companies entered and invested in the Chinese market, the government decided to realign the weighing scales and to re-equalize the status of local and foreign taxpayers. New updates to the Individual Income Tax (IIT) Law stipulate, that foreigners will no longer enjoy the tax-exempt benefit on housing expenses, education for children and Chinese studies. Instead, the government will adopt a new deduction system that will subtract a smaller portion of the foreign taxpayers’ overall income.

These regulations mark the end of the tax-exempt benefits to foreigners, and they are going to take effect in January 2022, after 3-year transition period. The changes in the wage structure will considerably affect companies who hire foreigners in China.

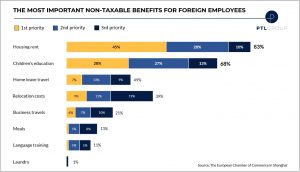

The constant rise in the cost of living in the big cities, and the pricey tuition fees for international schools, constitute a major economic burden on foreign families in China. This is evident in the findings of a survey conducted in February 2021 by the European Chamber of Commerce in Shanghai. According to the survey, 45% and 28% of respondents rated the tax-exemption benefits on rent and children’s education as the most important benefits attracting foreign labor to work in China. The elimination of the tax-exempt benefit on rental and children education expenses is about to lead to a greater IIT payable by foreigners in China and thus a decrease in disposable incomes.

How could these changes affect foreign companies in China?

Although the IIT is a personal tax, the hiring companies will most likely be the ones to bear the costs, so as not to worsen their employee’s conditions and detract from the attractiveness of certain positions. Therefore, companies are expected to experience a surge in the hiring costs of foreign employees.

Those most likely to be more affected are small and medium size companies (SMEs), which usually employ one foreign manager in China. It is already rather difficult to offer a new manager a relocation to China with the barriers around the COVID-19 pandemic; and for young companies who have recently set up their own operations, this might prove to be fatal for their company’s continuation in China.

Social benefits

Social benefit contributions in China are not fundamentally different from other countries. But there are two principles are worth remembering when talking about China. First, the contribution rate of employers to all employees’ social insurances varies from province to province. Second, some employers are willing to offer higher contributions to foreign employees, as an incentive to attract highly professional and skilled labor.

To conclude, the inclination to send a foreign manager to China appeals to many companies while establishing operations in China. But, the economic consequences of the move must be carefully considered. As the hiring costs of foreigners in China rise, it is worth considering hiring and training more local talents. Read more about recruitment and HR services in China

This post was written by PTL Group who provides management and operational support for international companies throughout their market entry and growth stages in China. The company provides multi-disciplinary services including recruitment and HR management, bookkeeping and financial management, supply chain management, manufacturing solutions, company registration and operation management in China.

+1-877-574-2407 (US and Canada Toll Free)

+1-877-574-2407 (US and Canada Toll Free)  service@limpid-translations.com

service@limpid-translations.com