Why These Foreign Brands Launched Localized E-commerce Sites in China

Want to know why these foreign brands launched their localized e-commerce sites in China? While they come from different industries, selling a myriad of goods to Chinese online shoppers, they knew starting an e-commerce site, whether launching a virtual storefront in Alibaba’s Tmall or setting up a localized version in an independent corporate domain, will impact online sales.

Chinese shoppers flock online to purchase goods. Their penchant for luxury foreign brands attracts these overseas companies to enter the marketplace. In short, e-commerce is the fastest growing sector.

Here’s why they’re moving in the China e-commerce hub:

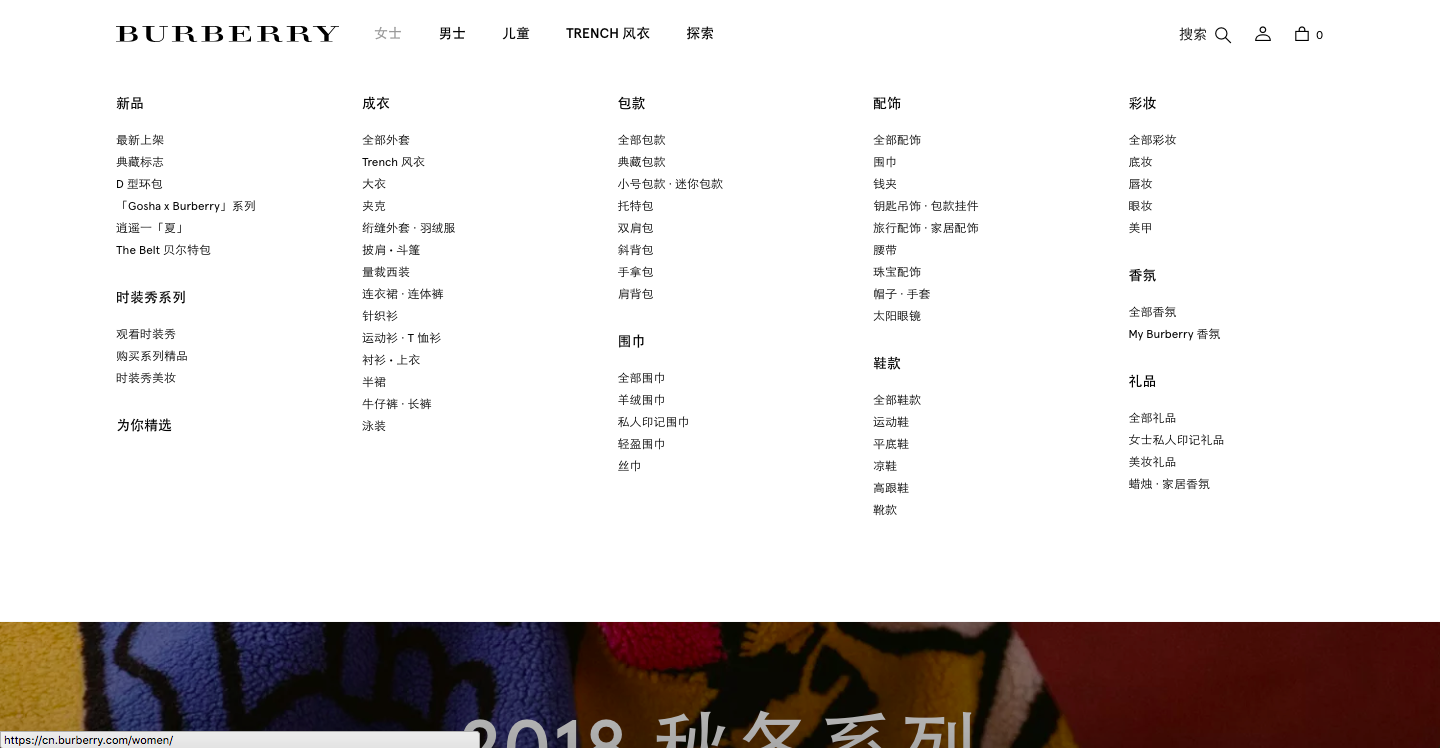

Burberry

Burberry wanted to expand its reach in China market, and the tie-up with Alibaba is a shared commitment to bring the best luxury experience to Chinese shoppers. The Wall Street Journal said, “The store is also a way for Burberry to gain better control of its brand in China since its goods have been sold on the so-called gray market online, a person familiar with Burberry’s strategy says.” Chinese online shoppers bought 1.84 trillion Yuan ($295 million) of merchandise in 2013, and it was in April 2014 the company piloted the virtual store.

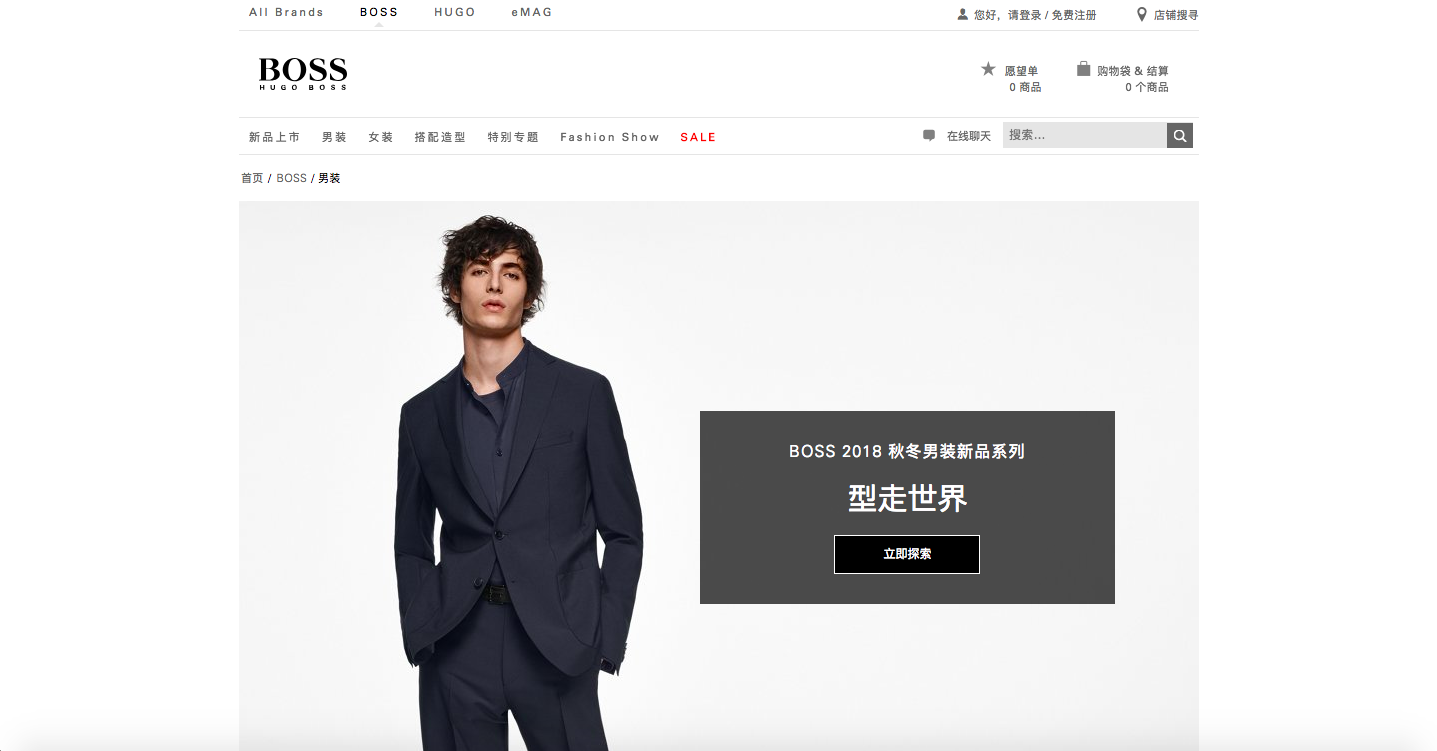

Hugo Boss

Hugo Boss has a unique way of marketing its merchandise to Chinese online shoppers—to create a buzz, they tap Korean international celebrities who are famous in China to boost sales. Their flagship stores based in Hong Kong aimed to target Mainland Chinese shoppers. “Asia delivers 15 percent of Hugo Boss’s global sales – €2.4bn (US$3.3bn) in 2013 – with China accounting for about a third of that,” The Financial Times wrote. “Mr. Lahrs says the company must make an even bigger push in China despite recent tough conditions.”

Hugo Boss localized e-commerce site was launched in 2013, and though the company experienced a competitive environment, with online sales in 2013 only accounted 1 percent, they believe China is a critical e-commerce market and will continue in their efforts until they develop over time.

Topshop and Miss Selfridge under Arcadia Group

Topshop and Miss Selfridge, the two subsidiary brands of Arcadia Group, entered the Chinese e-commerce market last Q3 of 2014 in partnership with Shangpin.com; the site was the first e-commerce platform to bring multi-brand and contemporary fashion items to Chinese shoppers. “As we continue to grow our global expansion, this will be a step forward using the power of China’s online reach and therefore selling into one of the world’s most exciting consumer markets,” said Philip Green.

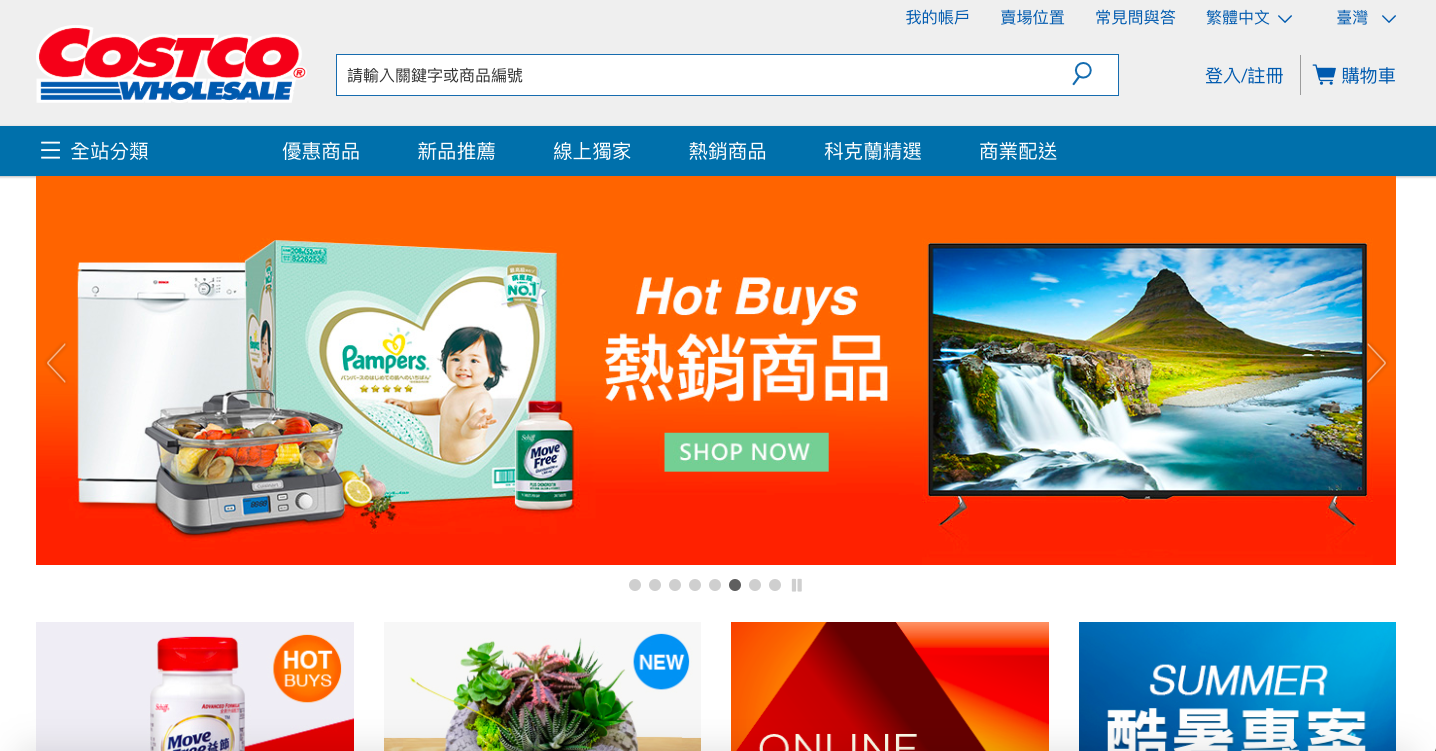

Costco

In October 2014, Costco, America’s largest membership-only warehouse retailer joined the Tmall bandwagon and launched its localized virtual store through Alibaba. This move allowed them to sell to Chinese consumers directly. Costco’s executive vice president said, “Costco sees tremendous growth opportunities in China, especially in light of Chinese consumers‘ increasing appetite for imported products.” In addition to the online store, the company said they would introduce new products solely for Chinese consumers.

Takeaway on e-commerce market in China

Foreign brands see the growing e-commerce market in China an opportunity to expand their reach and as part of their global marketing strategy. While there may be enumerable barriers in entering the industry, a brand can take it one step at a time by launching a Chinese website, whether as a corporate or partner with Chinese e-commerce platforms like Tmall or Shangpin.com to reach out the Chinese online shoppers.

+1-877-574-2407 (US and Canada Toll Free)

+1-877-574-2407 (US and Canada Toll Free)  service@limpid-translations.com

service@limpid-translations.com